|

SEVENTH G. D. ROY MEMORIAL LECTURE The Seventh G.D. Roy Memorial Lecture (for 2020) was held on Saturday, the 9th January 2021, at Science City (Mini) Auditorium along with a day-long National Conference on Contemporary Issues in Accounting and Finance. The distinguished speaker for the Memorial Lecture was Dr. Samirendra Nath Dhar, Professor of Commerce, and former Head of the Department of Commerce (three times) and former Head of the Department of Business Administration, University of North Bengal and his theme of presentation was Liquidity Balancing and Transaction Denial Imbroglios of Business Correspondents. |

|

|

|

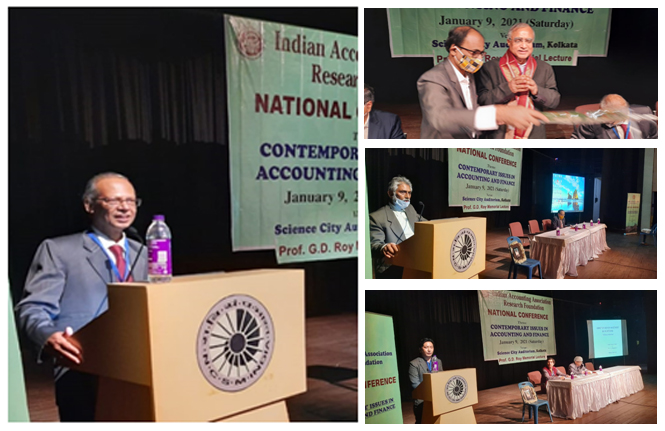

It is worthwhile to recollect the situation in the whole world due to Pandemic situation in 2019 and 2020. The Science City was closed during 2019 and 2020. With a resolution of the Executive Committee we met the Technical Officer of Science City, Mr. P. Satyanarayana, highlighting the necessity to build up confidence in the minds of delegates to come out of their homes and attend the Memorial Lecture and the National Conference. The Treasurer, Prof. Ashish Sana, the Secretary, Professor Dhrubarajan Dandapat and the Vice President, Professor R.P.Banerjee, were all very bold and supportive for holding the events in Science City. Mr. Satyanarayana appreciated the efforts of the IAA Research Foundation and mentioned that after two years it was the first event that was going to be held in Science City. Some of the distinguished delegates from other parts of the country, namely, Professor G. Soral of Udaipur, Professor Ranjan Kumar Bal of Bhubaneswar and Professor Samirendra Nath Dhar of Siliguri, all supported us by their kind presence in a difficult situation like the Pandemic. A little over 100 delegates attended the Memorial Lecture and the National Conference and on behalf of the IAA Research Foundation we express our gratefulness to all of them. The Foundation takes pride for the boldness of our members not only in academic activities but also in a risky situation like Pandemic. The brave-heart participants believed in the proverb that “God helps those who help themselves”. We now come to Memorial Lecture which was in the pre-lunch session (10.30 – 11.30 a.m.) and chaired by Professor Bhabatosh Banerjee, President of the Foundation. Though Professor Dhar is well-known to the delegates, as part of the rituals, he was introduced as a distinguished research scholar by Professor Dandapat. Professor Dhar introduced the topic in his usual style and stressed the need for deliberations of such an important topic as a G.D.Roy Memorial Lecture. Unfortunately, he could not meet the legendary research professor but heard his name while he was a student of graduate and post-graduate courses under the University of North Bengal. His way of presentation was simple and lucid but still penetrating to the audience. At the end of his presentation a lively discussion took place and some delegates raised several questions which were nicely dealt with by Professor Dhar. A hearty vote of thanks was offered by Dr Pinaki Ranjan Roy, Former Principal of Netaji Nagar Day College and a memento was presented to Professor Dhar by Professor R. P.Banerjee on behalf of the IAA Research Foundation. |

|

|

|

|

|

An abridged version of Professor Dhar’s presentation is given below. One of key strategies for enlarging the coverage of financial inclusion in India has been the introduction of the Business Correspondent model to deliver financial services as a low cost alternative channel to branch based banking for the poor and unprivileged population dwelling in the far flung rural areas. This study observes that activities involved in maintaining sufficient e- float and physical cash at the BC outlets to perform cash-in and cash-out transactions forms the crux of liquidity management problems. The onus to arrange liquidity lies with the BC agents as as they are responsible for operating the Customer Service Points with a condition that they will finance the Bank Settlement Account. The credibility and sustainability of agents depend to a larger extent in ensuring sufficient cash and e-float so that there are no transaction denials. The study on the basis of observational research and field surveys and examined whether transaction denials and customer dissatisfaction as a consequence of denials are in any way influenced by factors such as amount of e-float , transaction volatilities, rebalancing frequency, rebalancing time and bank support . Exploratory Factor Analysis and Confirmatory Factor Analysis were used to screen and identify the factors and Structural Equation Modelling was built on the dependence relationships between the exogenous and endogenous constructs. It was found that the earnings of the Business Correspondent Agents which are principally based on commissions on the type and number of transactions, get impaired if transactions are denied due to liquidity problems. The more the denials, the less is the earnings of the BCAs and more is the loss of credibility and trust from the customers. The study observed that since penetration of financial inclusion in India is largely dependent on a vigorous last mile agent network model there is an urgent need to resolve the liquidity problems but ushering in changes of the system. Prof. G.D. Roy Memorial Lecture was followed by the Plenary Session of the National Conference, chaired by Prof. R. P. Banerjee, Chairman & Director of EIILM Kolkata. Keynote addresses were delivered by Prof. Ranjan Kumar Bal, Former President of Indian Accounting Association & Formerly of Utkal University on Institutionalization of CSR within Governance: A Primacy for Value Creation and Mr. Sushovan Sinha, Regional Director of RBI, In charge, WB & Sikkim, on Corporate Governance of Indian Banking System-- Way Forward. In the post-lunch session, as many as eleven research papers were presented on different contemporary areas of accounting and finance in two technical sessions which were chaired by CMA Mr. Harijiban Banerjee, Former President, Institute of Cost Accountants of India and Prof. D.R.Dandapat, Secretary, IAA Research Foundation. The day long programme was ended with a hearty vote of thanks offered by Prof. Ashish Kumar Sana, Treasurer of IAA Research Foundation. On behalf of the participants, Professor G. Soral and Professor Ranjan Kumar Bal, both past Presidents of IAA, thanked the organisers for holding the G.D. Roy Memorial Lecture and the National Conference in such a difficult situation arising out of Pandemic. |

|

|

|

EIGHTH G. D. ROY MEMORIAL LECTURE The Eighth G. D. Roy Memorial Lecture was held on 27th September, 2021, from 2.30 to 3.30 p.m. jointly with EIILM-Kolkata at its Seminar Hall at 6, Waterloo Street, Kolkata-700 069. Dr. Sudhir S. Jaiswall, Associate Professor, Finance and Control Group, Indian Institute of Management Calcutta and the Coordinator of its Financial Research and Trading Lab, was the distinguished speaker. He spoke on The Role of Tax Risk in CEO Compensation (in the U.S.) based on a paper co-authored with Dr. Arpita A. Shroff of University of Houston Downtown, USA. It is claimed to be the first study to examine and document the role of tax risk in CEO pay. While the prior research examines the role of tax avoidance (lower tax rates) in CEO compensation, Sudhir and Arpita take a step further and examine the incremental role of tax risk, i.e. volatility in tax rates. They examine the following questions: Does tax risk play a role in CEO Compensation? If yes, does the prior average tax rate play a role in this association between tax risk and CEO compensation? The research questions are important in the current times as tax risk has become a major business risk in the recent decade. To examine the research questions, they use a sample of 25,126 firm-year observations over a period of 1992 to 2019 from the ExecuComp database. Both standard deviation in annual cash ETR (cash effective tax rates) and the volatility in cash taxes paid are used to measure tax risk in the main tests. The empirical model controls for tax avoidance, firm performance, risk, size, growth, membership in the S&P 500 Index, CEO tenure, and fixed effects for CEO, industry, and year. They use pooled regression and robust standard errors clustered at firm level. According to them, tax risk plays an incremental role in CEO compensation. They find a positive and significant association between tax risk and CEO compensation after controlling for the role of tax avoidance. The results suggest that one standard deviation increase in the measure of tax risk is associated with an increase of 1.37 percent. Next, the median value of average cash ETR is used in the sample (25.1 percent) to create two subsamples – low-tax firms and high tax firms. It is found that tax risk plays a significant role in the determination of CEO compensation in high-tax firms but no evidence of such association in the subsample of low-tax firms. Thus, current tax risk does not provide any additional premium to CEO compensation for firms that have had lower tax rates in the prior periods. In terms of economic effect, the results show that, compared to low-risk firms, CEOs of high-tax firms on average receive additional compensation for one standard deviation increase in the tax risk measure. Finally, they conduct several robustness tests using other measures of tax risk specified in prior literature and the results are qualitatively similar to those of the main tests, although their economic significance is higher. They also perform additional tests for variable element of compensation and find the role of tax risk in variable CEO compensation (particularly stock grants and other components). However, they find no such association between tax risk and the fixed component of CEO compensation. Additional cross-sectional tests suggest that tax risk plays a role in CEO compensation in multinational and high leverage firms. Thus, the study contributes to the literature on CEO compensation by enriching the understanding on its determinants. At the beginning, Professor Bhabatosh Banerjee, who chaired the session, introduced the distinguished speaker and also the topic. The presentation was very simple but penetrating so much so that they promoted lively interaction. At the end, Professor Tanupa Chakraborty offered a hearty vote of thanks. |

|

|

|

Before the Session started, Professor R.P. Banerjee, Director, EIILM-Kolkata, and Vice-President, IAA Research Foundation, sought permission from the Chair to give him a few minutes time to felicitate Prof. Bhabatosh Banerjee for his contribution to academics. He mentioned that it is the unanimous decision of the faculty members to take advantage of the presence of Prof. Banerjee and give Institute’s maiden Award to Prof. Bhabatosh Banerjee. The Director, EIILM-Kolkata, then presented a Plaque to Prof. Bhabatosh Banerjee which stated: “Best Teacher” and Dr. Bhabatosh Banerjee in response thanked Prof. (Dr.) Banerjee and his colleagues for the selection. He expressed his gratefulness to the Director of the Institute, its faculty members and staff. The delegates present expressed their appreciation by a standing applause. |

|

|

|

NINTH G. D. ROY MEMORIAL LECTURE The Ninth G. D. Roy Memorial Lecture was held on 3rd September, 2022 during 11.00 am to 12.00 noon, organised jointly with EIILM-Kolkata at its Seminar Hall at 6, Waterloo Street, Kolkata 700069. Dr. M. Harunur Rashid, President Bangladesh Accounting Association, Former Professor of Accounting, Dhaka University, Bangladesh, former Vice-Chancellor (2007 – 2012), Presidency University, Dhaka, and one of the Ph.D. Scholars of Prof. G. D. Roy, was the distinguished speaker. He deliberated on The Role of Accounting in Changing Environment: Some Thoughts. |

|

Introducing the Speaker |

Prof. Rashid started his discussion with evolution of accounting mentioning that accounting has always been an essential part of human civilization since antiquity with its many-fold contribution in the management of resources for their beneficial use in economic and social progress and prosperity. Thereafter, he discussed how,in pursuance with societal transformation,accounting has continuously assumed the transition with every innovation to elevate the practice and profession in harmony with human urge for the discharge of accountability and good governance. |

Felicitation |

Presentation by Prof. Rashid |

|

He mentioned that as technological innovation continues, human being seemingly leapfrogged ten years in a matter of month. This has thrown before accounting-a billion dollar question- how can accountants help position their functions and in turn help the economy and business navigate their way toward a more rewarding, sustainable future. He reminded that the call is already afloat for the discipline to navigate through new horizon with a focus on adaptation with appropriate technology and building skill-based human resources for the future. Internet of Things (IoT) driven Cloud Computing, Blockchain, Artificial Intelligence (AI) are some of the key areas of automation that are set to change the face of accounting operations, delivering efficiency, reducing errors, and optimizing workflows, while assisting professionals with real-time economic decision-making based on insights driven by accounting Data.Accounting is no longer the cold, stagnant industry that it once was. He concluded suggesting that accounting education system needs suitably revamped, and in view of the intimate relationship between teaching (education) and research, more emphasis should be placed on research, and a healthy relation with the accounting profession should be maintained with real-time economic data. This precisely represents the future of accounting-at the moment. Accounting is no longer the cold, stagnant industry that it once was. He concluded suggesting that accounting education system needs suitably revamped, and in view of the intimate relationship between teaching (education) and research,more emphasis should be placed on research, and a healthy relation with the accounting profession should be maintained. |

TENTH G.D. ROY MEMORIAL LECTURE (02.09.2023) INTERNATIONAL CORPORATE INCOME TAX IN DIGITAL ECONOMY: CHALLENGES AND INITIATIVES by Professor (Dr.) K Eresi, Former Chairman and Dean, Faculty of Commerce, Bangalore University |

|

|

The Program started with lighting of lamp and Saraswati Bandana followed by the Memorial Lecture. The International tax laws existing at present were designed on two fundamental elements namely ‘nexus' (physical presence) and ‘profit allocation‘ (arm's length principle). No doubt the laws based on these two elements served their purpose very well by eliminating double Taxation, stimulating global trade and providing tax certainty. But, these century old tax rules developed in ‘ Brick and Mortar ‘ economic environment could not address new tech based business models based on intangible and value driven products and services challenging both ‘nexus, and ‘ profit allocation ‘ rules. The Multinational Enterprises ( MNEs) through their tax planning strategies started taking the advantage of tax avoidance through ‘Base Erosion and Profit Shifting' (BEPS) to low tax or no tax jurisdiction. Even though It is difficult to determine total revenue loss , but, one estimate of OECD states that the cost of MNEs tax avoidance ranged from 4% - 6% working out to USD 100-240 billion specially to developing countries. Therefore, a strong need was felt to develop a tax eco- system that would encompass trade, manufacturing and digital businesses which is effective, predictable, and sustainable contributing for economic growth and global welfare. Accordingly, OECD/G-20 took the initiative of revamping international tax laws that would address fast growing cross border transactions including tech based digital businesses and also check the strategy of BEPS by MNEs in the world. This initiative is taken up from 2013 under project mode. Since then almost a decade now the OECD/G-20 is interacting with global economies by holding conventions and releasing public documents containing draft rules and inviting comments/suggestions. The stakeholders in the process included civil societies, parliaments, NGOs, academics and others. In fact the whole aim of the project is to move towards standardisation and stabilization of tax rules across the globe. The outcome of the project OECD/ G-20 Inclusive Framework so far is release of TWO pillar solutions outlining rates, threshold , and dates of implementation. The Memorial Lecture was organized on 2nd September, 2023, at EIILM-Kolkata Campus at DN9, Sector V, Salt Lake City, Kolkata-700 091. Professor Bhabatosh Banerjee, who chaired the session, congratulated the learned speaker for elaborating such a complex issue nicely before the delegates. There were a number of questions when the session was made open to the delegates and Professor Eresi answered each question to the satisfaction of the delegates. Professor Dhrubaranjan Dandapat, Secretary of the IAA Research Foundation, thanked Professor Eresi for travelling such a long distance for the Memorial Lecture. He also thanked Professor R.P. Banerjee, Chairman and Director of EIILM-K, for making excellent arrangements. |

ELEVENTH G.D. ROY MEMORIAL LECTURE [21.09.2024] Philosophy of Accounting and the Changing Dimensions of Corporate Financial Reporting by Dr. Ananda Mohan Pal, Professor and Former Head Department of Business Management, University of Calcutta |

|

|

This talk is my tribute to the memory of Professor G D Roy, intended to unveil the truth underlying the changes in the financial reporting in the light of basic concepts of accounting. Over time, it is observed, that philosophy of accounting is open to accommodate interest of all the stakeholders of an economic unit operating in a society. On the contrary, financial reporting is getting more focussed to the owner-investors, i.e. the providers of risk capital only. Based on the entity concept, accounting equation stands as: Equity = Assets – Liabilities. When assets are greater than liabilities, equity is positive and interpreted as claim of the owner over the net assets of the firm. But when liabilities are greater than assets, leaving a negative balance of equity, it may not be simply interpreted as claim of the liabilities (creditors) over the equity (owner). The conversion from unlimited risk bearers to the modern shape of limited liability has taken place during last three centuries protecting shareholders at the cost of the creditors. The Framework 2000 of the ICAI recognises present and potential investors, employees, lenders, suppliers and other trade creditors, customers, governments and their agencies and the public as users of financial statements. The Conceptual Framework (2021) of the ICAI recognises only three user groups, (i) existing and potential investors, (ii) lenders and (iii) other creditors as primary users. The enterprises were encouraged to present Value Added Income statements in IAS 1 in 1997 version, but in the revised version of the IAS 1 starting from 2004, this encouragement disappeared, pushing value added statements outside the scope of the International Financial Reporting Standards (IFRSs). A major lesson learned by accountants as a result of the Great Depression was that market values are fleeting. The outcome was a strengthening of the historical cost basis of accounting based on the concept of the firm as a going concern. Ind AS 1 also requires management to prepare financial statements on a going concern basis. However, the trend in the twenty first century is to move steadily towards market-based exit value, away from historical cost or entity specific value-in-use, which is not consistent with going concern concept. Such inconsistencies make financial reports too complicated to the ordinary investors. Maffet (2012) distinguished between ordinary and sophisticated investors. Sophisticated investors are superior to the ordinary investors in interpreting the available information. Complicated general purpose financial statements lead to information advantage of the sophisticated investors over ordinary investors and higher abnormal return of the sophisticated investors at the expense of the ordinary investors. While accountability to all the stakeholders is ideal for accounting, it appears that the focus of financial reporting is narrowing down to primary users among all the stakeholders, to the investors of financial capital among the primary users and to the sophisticated investors among the investors. Prof. Ananda Mohan Pal was requested to make his presentation first in view of constraint of time. |

|

For the same reason, the phrase “philosophy of accounting” could not be elaborated by the learned speaker. Professor Bhabatosh Banerjee, who chaired the session, spoke a few words on “philosophy of accounting” and pointed out the compulsion of presentation of financial statements and their changing dimensions because of societal and regulatory requirements. He thanked the learned speaker for suggesting a wonder topic for presentation and stressed the need for research by the members of the IAA Research Foundation. |

IAR Endowment Fund The Executive Committee decided in its meeting on 18th June, 2014 to raise the present Endowment Fund to meet printing, distribution and other expenses of IAR (estimated at about Rs..75,000 p.a. for two issues) by inviting donation from members and others a minimum amount of Rs.5,000/- per member which contribution will attract tax benefit under section 80-G of the Income Tax Act, 1961.The target is to raise an additional fund of Rs.5,00,000. The AGM held on 26th July, 2014, approved the decision. Accordingly, members are requested to contribute generously to the IAR Endowment Fund by cheque in favour of IAA Research Foundation and send it to the Editor (Dr. Bhabatosh Banerjee, 164/78 Lake Gardens, Flat B-10, Kolkata-700 045) along with a forwarding letter giving details of the member concerned (viz. name as per PAN and mailing address). On request willing members may also get particulars of Foundation’s bank account for transferring donation through their respective bank accounts. The names of the donors will be displayed in the Foundation’s website which will be updated from time to time.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Home || Site-Map || Journal || Contact Us